YangZiJiang Financial Holdings – Game On!

- Squirrel

- Mar 28, 2023

- 4 min read

Updated: Apr 11, 2023

Given the hiatus in this blog for a rather long period of time, there is a lot to go through with the latest results release. There are multiple meaningful events that has occurred that I believe has made YZJ Financial Holdings more valuable fundamentally.

Relief of Selling Pressure

There has been some talk of T Rowe sales been the cause of the price drop from listing.

As per the following announcement, T Rowe had a total of 295,981,100 shares across multiple funds.

https://links.sgx.com/FileOpen/_Form%203...eID=716131

The following T Rowe funds reported holdings on YZJ FH across them with some smaller holdings that I didn’t sift out in their smaller funds. I can’t tally to the total, but I guess there are some holdings in non-public funds. The following are for Mar 2022 and Sep 2022 holdings respectively showing a reduction to zero.

T. Rowe Emerging Markets Discovery Stock Fund – 73,546,600

https://individual.troweprice.com/static...hemvq1.pdf

https://individual.troweprice.com/static...hemvq3.pdf

T. Rowe Price International Discovery Fund – 53,653,600

https://individual.troweprice.com/static...hidfq1.pdf

https://individual.troweprice.com/static...hidfq3.pdf

T. Rowe Price International Value Equity Fund – 32,040,300

https://individual.troweprice.com/static...higiq1.pdf

https://individual.troweprice.com/static...higiq3.pdf

All the funds above indicate zero holdings as of 30 Sep. Assuming the funds follow a general house view and sells from all their funds together, they seem to be done with the selling of a very sizeable amount of shares (assuming all 296m, but we won’t know for sure since holders below 5% threshold does not need to report change in holdings).

Share Buyback – Work in Progress

Up to 21 Mar 2023, the company has bought back 276,611,100 shares at total proceeds of $105,271,857.16, which is per share average of $0.3806 and highest price paid at > $0.50. This is about 7% of outstanding shares and approaching the 10% limit in treasury shares holdings. That leaves 118.5m more shares to buy back with an estimated $44m at current price of $0.37. That still leaves a lot of money for further buy backs. There has been repeated declarations from Ren of his intention to buy back shares personally once the buyback mandate has been fulfilled, and to refresh the share buyback mandate while cancelling treasury shares.

A Simple Simulation

The current price that the shares are trading at presents a very unique opportunity for a huge shareholder value enhancement exercise, lo and behold, its already under way! And that is the dividend policy of distributing 40% of earnings and the share buybacks that are ongoing.

Let’s make the following assumptions

- the share price stays at $0.37.

- the company buys back 10% of the outstanding shares per year

- the company pays out 40% of earnings per year

- the company manages 8% ROE per year going forward (it made around 7.7% ROE in 2021 and I believe 8% is in fact a conservative assumption which I will explain further later in the post)

In 3 years, even if the share price were to stay unchanged at $0.37, what would happen is that an individual shareholder would have pocketed 33.4% in dividend yields, and would be holding an security that would boast a PE ratio of 3.04 and PB ratio of 0.24. I believe the assumptions are very manageable, with dividends and buybacks being financed by each year’s earnings.

Catalysts for growth

The 3-year simulation above does not include the following factors that might contribute to a higher ROE than 8%.

Increase in Rates with compounded sensitivity on low P/NAV

With the increase in rates globally, these would bring about higher returns down the capital structure. That’s the advantage of holding cash or near cash now. Even a one-year US Treasury Bill would fetch > 4% yield in the current climate compared to a year ago. In valuation terms, as more risk is taken in an investment, it necessitates a higher rate of return to justify the investment, thus higher returns required in equity versus debt and so on. Sensitivity of the ROE to such rate increases are compounded by virtue of the company trading at a third of its NAV.

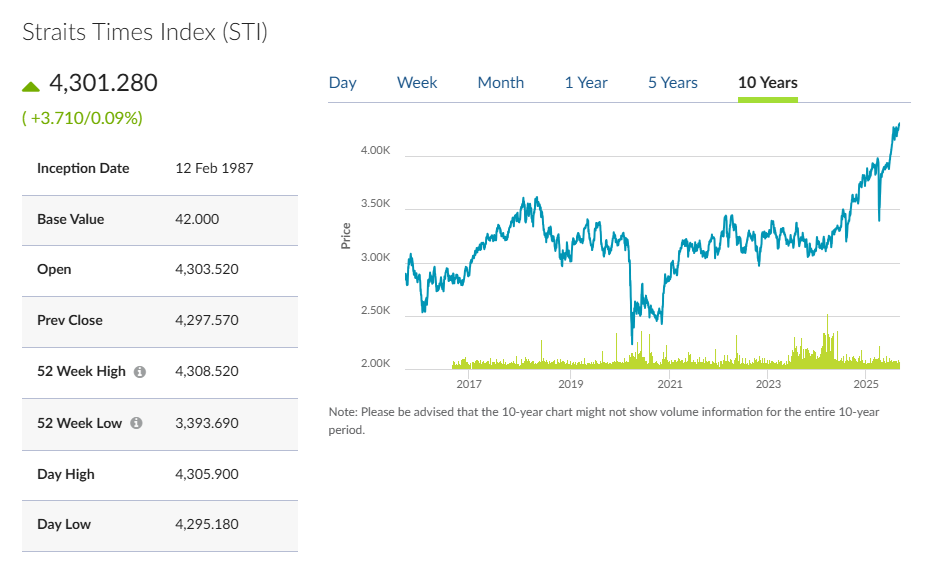

Source: CNBC

Fund Management Business

The growth of the fund management business has not been included as part of the ROE for the company. The company has made the logical move of setting up a fund in a sector that they are very familiar with and has the cooperation of the shipbuilding company which would prove very handy if the loan goes south. Collateral management and monetisation would be so much easier with YangZiJiang Shipbuilding in the picture.

The announcement of a tie up with ADDX (company was mentioned in a prior blog post) had given a glimpse of how such fund businesses can grow in the future. What could have been easily missed is the proclamation “The Maritime Fund has a target fund size of US$600 million and has secured capital commitments of US$500 million.” This would indicate that the company has secured an additional US$300 million on top of YZJ FH’s $200 million commitment. That is an achievement for a new kid on the block.

Source: SGX Announcement

Recovery in China Property Sector

This factor is a double-edged sword. Over the course of the last quarter, the company has announced startling figures of non-performing loans. This has resulted in provisions being made on the loans that dragged down the results for 2022. The downside would be a further write down in these NPL. There are signs of green shoots though going into the new year with an increase in home sales for the first time in 20 months in Feb 2023.

Source: YZJ FH presentation slides

Conclusion

As readers would know, I am invested in this company and intend to carry on holding it for the long term due to the buffer of safety from its strong balance sheet. The management seems to be rather proactive in disclosures, giving updates on important matters every now and then. What I would like to see in 2023 would be more shares buy backs. It’s a bargain for how much the company is trading at now. Understandably, the availability of funding is the life and blood for a fund manager, allowing co-investing alongside other managers to generate the required returns for shareholders, or anchor new funds to be managed by the company (Eg. Maritime Fund). However, the opportunity to buy back shares at such a cheap price doesn’t come often, and hopefully the management of YZH FH will take advantage of it. For now, I would just wait for the 1.8cts dividend to come in, and for time to do its magic.

Disclaimer: All posts on The Squirrel's Drey are for informational and discussion purposes only. This is not a recommendation to buy or sell securities discussed. Please do your own due diligence before investing.

Hi, to address a query raised by an investingnote's user about all 6 links showing only YangZiJiang Shipbuilding shareholdings only and not YZJ FH shareholdings. The first 3 reports are as of Mar 2022 which is prior to the spin off in Apr 2022 thus T Rowe only shows YZJ SB shareholdings. By Sep 2022, they were all out of YZJ FH which is why the latter 3 shows 0 YZJ FH shares.

Please refer to the following links for the intermediate holdings in Jun 2022 that shows YZJ FH shareholdings before they sold out of it in the funds listed.

https://individual.troweprice.com/staticFiles/gcFiles/pdf/phemvq2.pdf

https://individual.troweprice.com/staticFiles/gcFiles/pdf/phidfq2.pdf

https://individual.troweprice.com/staticFiles/gcFiles/pdf/phigiq2.pdf