Now is the best time to be invested in the Singapore equity market

- Squirrel

- Sep 26, 2024

- 6 min read

I pen this post in a different direction from previous posts that focuses research into individual companies. This is, rather, a retelling of a conversation held with longtime friends on the virtues of investing in the Singapore equity market. Typical opinions cast Singapore as an illiquid market with numerous value traps lying in wait to tie up one’s capital. Most would point towards the most liquid market in the world, the United States of America, as the most ideal place to plough one’s resources that would see immediate accretion to said wealth. As one of them puts it, “It’s all about the flow of money.” Value investing is no longer trendy with the rise of growth investing and its mark in minting new multi-millionaires, waving around their new fortunes on the latest social media platforms.

In these conversations, I postulate that this is the best time within the last decade or so to be invested in the Singapore equity market, and here’s why.

Cheap Valuations

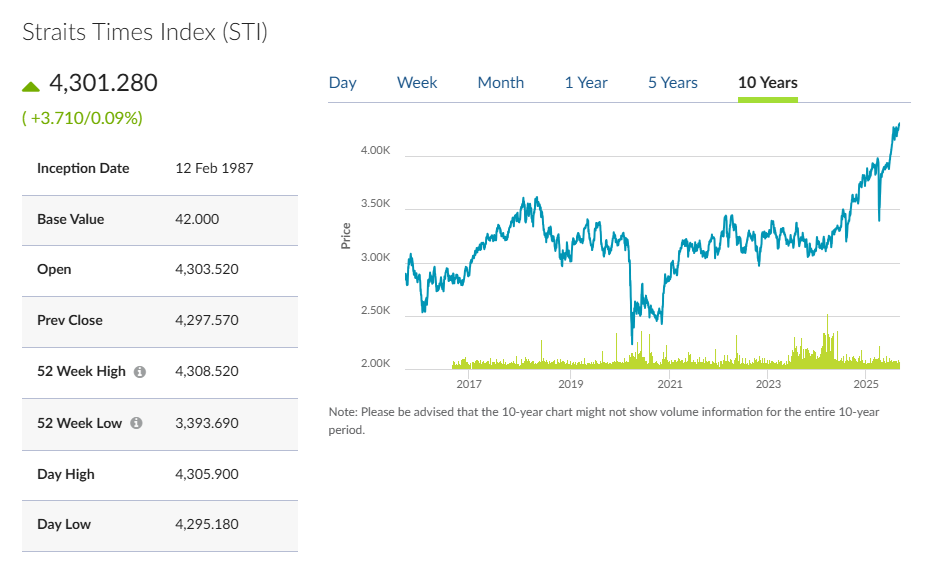

It has been repeated time and again, on mainstream newspapers, on my website and on various forums that companies listed on the SGX are mind boggling cheap. Over the last 17 years from the last peak in 2007, the STI has gone sideways and nowhere. It was during this period that companies that have shown themselves to be profitable year after year, accumulating cash over these years of profitability and yet having their share price stagnated at the same level. The number of companies trading below book value is astonishing, with some even trading near net cash levels. P/E ratios are low compared to historical and global averages.

I think you get the gist of it. It’s cheap. And with cheapness comes asymmetrical returns profile, that should be what any investor should look for in their investments. It limits risk and allows an investor to outsize the investment in one’s portfolio with respect to the lower risk involved. In laymen’s terms, it allows one to bet the farm without losing sleep.

Getting paid while waiting

The peculiarity of the Singapore equity market also results in multiple listed companies offering up decent dividend yields year on year. And I am not talking about the REITs that are listed here. On a side note, I don’t invest in REITS. It’s not so much about avoiding the sector since everything is about risk versus reward. I have never gotten around in my mind how investors require so little returns from REITS. Personally, I would require more in terms of returns to be holding onto the equity end of the capital stack. A lot more. Look at what the banks are getting paid in their loans and look at what an investor is getting paid from mandatory dividend payouts. Is the spread reasonable? And REITS do not offer much growth. Acquisition of new assets would require capital injection from investors unless the capital is recycled from selling older assets. Any capital appreciation is likely to be a function of interest rates than organic growth.

I have digressed. As mentioned in my previous posts, there are many Singapore listed companies that pay out dividends at around 5% yields that pays investors while they wait. Opportunity cost is defrayed with this in mind.

MAS task force

The local investment community has been abuzz with the news of MAS setting up a task force with participants from Temasek, MOF, SGX, EDB etc. The taskforce is being chaired by Second Minister for Finance Chee Hong Tat. Although the appointment of the chairperson does not inspire confidence (cue the rollout of SimplyGo and the quality of ERP 2.0), this task force is still a potential game changer. The good news for the task force is the abundance of precedent policies implemented by other exchanges.

These includes

naming and shaming of companies to improve corporate governance (Tokyo)

setting up state backed funds to support the equity market (Thailand)

prioritising shareholder returns with incentives including tax benefits (Korea)

boost the image of certain sectors that can lead to rerating, improved valuations and subsequently IPOs/secondary listings from other nearby countries (semiconductor industry in Malaysia)

actively pursue local primary/secondary listing for tech companies such as SEA, Razer and Grab that are headquartered in Singapore (such as GoTo in Indonesia)

From my point of view, getting positioned before any changes are announced is the way to go.

Momentum in local equity market

There is a certain truth to a momentum strategy and something infectious about reclaiming an all time high. It attracts investor attention as well as garners optimism over where the market is heading. The STI is not far off from its all time high that was set in 2007. Hopefully, the milestone can trigger more articles and encourage more market participants to dip toes in the local market again. The continued work into strategy reviews and corporate restructurings for local companies has unlocked value, which would help in powering further gains in the index (Keppel Ltd, SembCorp Industries, Seatrium, SATS, Singtel). Suffice to say, rotations into Asian markets had bode well for Malaysia, Taiwan and India in 2024. Who’s to say that the combined influence of the above won’t broaden the rally and attract rotations into the SG market? Do you want to be left out if that happens?

Culling before growing

Consider the local market to be a pot of liquidity. Some parts of these liquidity are stuck in OPMI unfriendly companies that do not pay heed to corporate governance, nor actively optimise their capital efficiency. Wouldn’t this liquidity be better deployed elsewhere? Over the recent years, there has been waves of privatisation and delisting dominating the headlines. Just this year alone, multiple companies are undergoing privatisation or takeovers such as Silverlake Axis, Best World, Dyna Mac, Second Chance, NSL Ltd, Great Eastern, Boustead Projects and Amara Holdings. Expectedly, after the MAS review, I would expect that it would get more difficult for listed companies to stay below the radar and ignore corporate governance. Some might prefer to take their companies private instead of the hassle of handling these questions. Some might think of taking the company private now and relisting at a later date for a more desirable valuation. Companies used to go to the public market in order to raise capital. With the rise of private equity shops, and prevalence of valuation techniques, the private equity market is the new public market. Pledging of shares in private equity is also more commonplace and makes financing accessible to Founders and the clans that come with them.

With all that being said, I would expect more privatisations to take place while this review is ongoing. And since these privatisations normally occur at a premium to the last traded value, wouldn’t that be a quick buck for an exit? Personally, even though these culling would result in a smaller market, but I would think its for a greater good that would contribute to a more vibrant scene and better valuations for those that remain, which in turn would attract more companies to IPO here.

A culmination of conditions

What’s next? Let’s recap the conditions of the Singapore equity market. For one, there is an abundance of cheaply traded shares with limited downside. A subset of these pays a decent dividend to compensate an investor while waiting. To me, buying into these shares would result either of the most likely outcomes below.

Market capitalisation dips and shareholders suffers a small loss while enjoying annual dividends

Share price goes sideways with the task force not making much of an impact, and the investor is paid a dividend yield year over year

The company privatises at a 20% - 50% premium to last traded price

The task force makes multiple impactful changes at the same time, bolstering support for the local market and attracts the latest tech startups to list. Companies’ valuations rerate with heightened interest. The Singapore startup scene has always been a big draw in Southeast Asia (21 of the NextGen 30 Tech list is from Singapore). It’s a pity that doesn’t translate to more listings in SGX.

Yes, I think it’s a good time to be invested in the local SG equity market. And I hope you can be convinced with the reasoning presented thus far.

Disclaimer: All posts on The Squirrel's Drey are for informational and discussion purposes only. This is not a recommendation to buy or sell securities discussed. Please do your own due diligence before investing.

Comments