A Book Review, A Structural Shift and A Change in Pace

- Squirrel

- Feb 19, 2024

- 4 min read

It has been way too long since the last post was made on this website. That’s because I had moved on to a new phase in life and priorities took a shift last year. The change had meant that I should end up having a lot more time on hand, but most of that went to family, exercise, reading and retuning my portfolio to meet my updated needs. Strangely, the longer it has been from the last post, the harder it becomes to start penning down thoughts again. Thus, here I am, in an attempt to get my engines started.

I would like to start off with some takeaways from a book that I have read recently,<The Missing Billionaires> by Victor Haghani and James White. Victor hails from LTCM, and has a lot of personal experience to contribute to the book when the fund blew up in spectacular fashion. The book primarily focuses on how one should appropriately size their investments relative to their net worth. The title draws on the thought experiment that if the wealthiest families had spent a reasonable portion of their wealth and invested it, there should be many more billionaires today. Their errors in sizing had resulted in the demise of what would have been generational wealth.

There are two main takeaways that I would like to highlight that I find very important and my interpretation of them.

The utility function of an individual should be consciously included in investment sizing decisions. The diminishing marginal utility of every added dollar should mean that each individual investor should avoid “All in” scenarios, as the expected utility of such a decision would likely turn out negative. That goes the same for bets that are more volatile in nature. More calculations would be covered in the book, but I find some of the examples inside that can form rules of thumb helpful.

The second important takeaway is that one must consider for human capital. In short, one should see one’s career as a series of cashflow and thus discount it to the current present value. This is a very important view to hold early in one’s career life. If one’s cashflow is more equity like and form a large part of total current net worth, it would make sense to invest available cash on less risky instruments. If the cashflow is more stable and predictable, it would make sense to invest most of your available cash into equity. That is because in both cases, human capital is likely to count for a large portion of one’s total net worth at this stage in life.

Point 2 made a lot of resonance with me. Historically, I had put in near to 100% of my excess cash into the equity market right from when I started working. I did not grow up with a silver spoon, thus my capital outlay at the start was really low. There were points in time when I could hold 50% of my portfolio in one single stock. Back then, I had reasoned with myself that this is alright as my income was growing my portfolio at such a fast rate that the 50% concentration would not matter in a few years’ time. Lo and behold, I had absentmindedly stumbled onto the methodology that the authors are speaking about. And it’s a much clearer way to view the decision-making process. This has also influenced how I reformed my portfolio in the past year due to the change that took place in 2023.

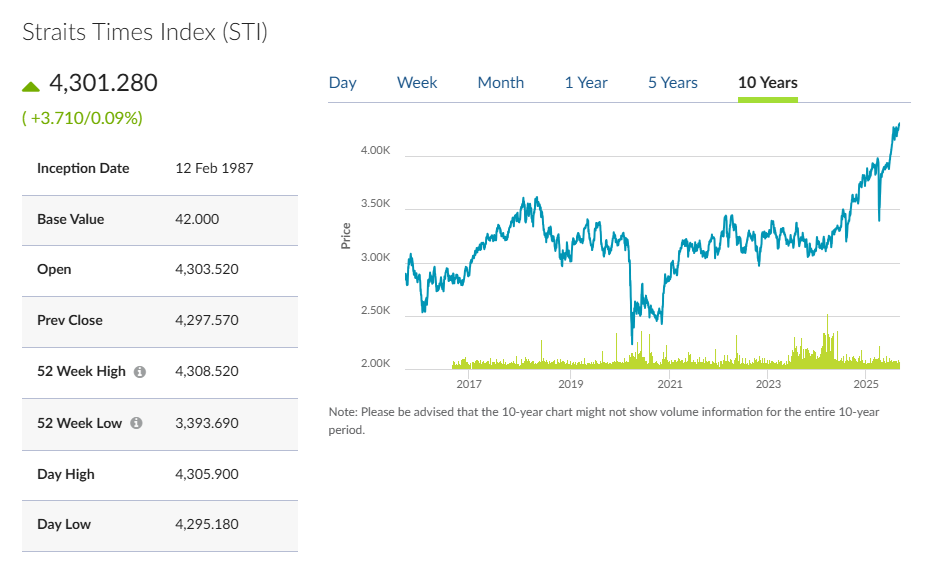

My view of the world now is that markets have gotten used to low rates so much that they are expecting for rates to normalize lower again. Barring the last ten years, even if the rates were to stay unchanged at the 4%-5% levels, it doesn’t seem excessive from a historical basis. Years of cost savings from globalization are reversing out. Climate costs are slowly getting additionally factored into mining, manufacturing and production. Wars are being raged on multiple fronts. Personally, I won’t be surprised if rates stay higher for longer. Accordingly, I have overhauled my portfolio to both reflect my current situation and this view of the markets. Hopefully, in the next few entries, I can share some names for readers to discuss and deliberate on. And hopefully, that won’t take too long.

Lastly, I will be making a change to how I manage this blog. Prior, I had indicated that I would try to inform my exits on the names that we discussed. I am going to drop that approach altogether. My consistency in posting impedes this initiative, and so would defeat the purpose. Most of the names I covered did appreciate and subsequently fall back. Catching that peak in a timely manner with my frequency of posting will be tough. This is not meant to be a webpage advocating short term trading anyway. And finally, my exit points might not be the best as you can see from Samudera Shipping. I figured the best utility to readers might be for me to omit this feature.

Wishing everyone a Happy Lunar New Year! And hopefully we can run through a few names for discussion before the financial results are all announced!

Disclaimer: All posts on The Squirrel's Drey are for informational and discussion purposes only. This is not a recommendation to buy or sell securities discussed. Please do your own due diligence before investing.

Comments