China Aviation Oil – The Buzzsaw that accompanies the Takeoff

- Squirrel

- Nov 7, 2025

- 5 min read

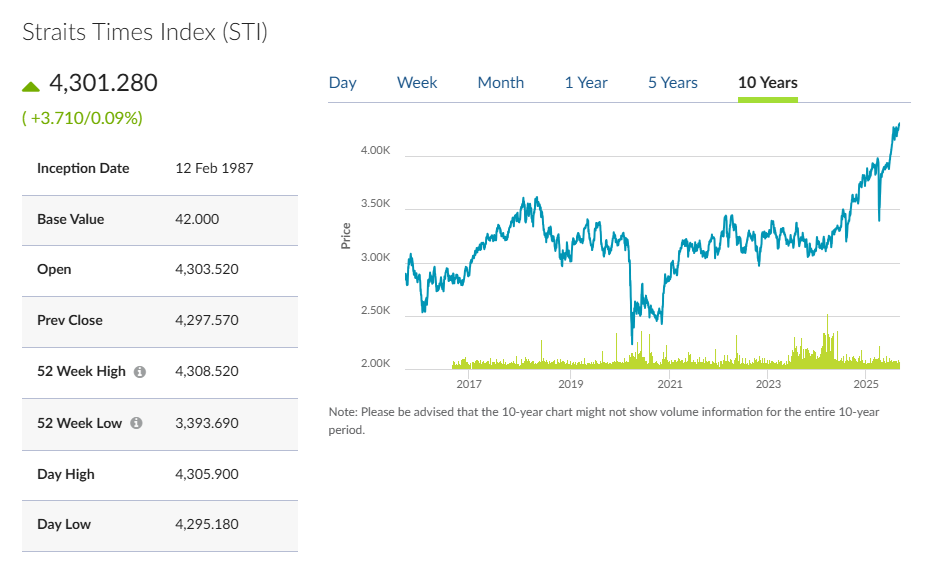

The last entry that initiated a discussion of the company, China Aviation Oil (“CAO”), was posted on 27th Feb 2024. It was trading at $0.94 per share. Since then, the company has paid out $0.0505 in dividends in 2024 and $0.0372 in dividends in 2025. As of the last trading price of $1.55 on 6th Nov 2025, that brings returns to 74.7%. In the current SGX bull market, it doesn’t really stand out amongst various companies hitting all-time highs, and touting bagger levels of price appreciation. So, the question is, is China Aviation Oil still undervalued?

Research Coverage

Since the revival of interest in China Aviation Oil, various research houses have resumed coverage on the company with the following target prices, to the best of my knowledge.

Phillip Securities - $1.50 (As of 18 Aug 2025)

OCBC Securities - $1.50 (As of 19 Aug 2025)

CGS International - $1.52 (As of 9 Oct 2025)

DBS Group Research - $1.75 (As of 29 Oct 2025)

Are these TPs going to be updated again with the latest developments in the parent company, China National Aviation Fuel’s update of having an ongoing restructuring? Allegedly being a merger with Sinopec?

All this on the back of Elliot’s drive to push British Petroleum (“BP”) into selling off non core assets. BP is currently holding 20% of outstanding shares in China Aviation Oil. Notably, CAO’s share price has been pretty volatile since the release of the corporate update, and rightfully so.

Valuation of CAO

I have refrained from outright DCF valuation of individual companies, because I do have a deep belief that the method is very subjective and dependent on the inputs to the discounted cashflow. In this case however, I would like to offer up an alternative methodology that would give an indicative floor value for CAO. Please feel free to discuss this in the comments section.

As of time of writing, the market capitalization of CAO is at S$1.33 billion. CAO holds US$515 million in cash which is circa S$670 million equivalent. How I am going to approach this, is viewing the value of CAO excluding Shanghai Pudong International Airport Aviation Fuel Supply Co Ltd (“SPIA”) as the cash value. Logically, most people would deduct the cash from the equity value to reach the enterprise value. However, the actual deduction should be on excess capital that the company does not need for working capital. Without working capital, there would be no business. Understandably, an oil trader would require quite a large working capital to facilitate its business flow. However, we do know as well that the cash buildup in the company has far outstripped the growth in revenue. Therefore, excess cash is not zero, but not the full US$515 million either.

Such a simplification might be outrageous to some, but to me, I know what I don’t know. And I don’t know the workings of fuel trading well enough to confidently designate valuation metrics to this section of the business. Multiple analysts point to Sustainable Aviation Fuel as an area to look out for that would increase margins at CAO, but I am not privy to such information.

Moving on, that leaves S$660 million in market valuation that is assigned to SPIA. For 1H25, the company reported SPIA’s profits after taxes at US$25.49 million. This has yet to reach the pre pandemic highs of US$34 million at its peak. Assuming that 1H25 profits is the new norm, that would place the valuation of SPIA at 10x P/E. At this juncture, it would be a good time to revisit figures relating to Shanghai Pudong International Airport.

Source: SSE

As you can see in the two graphs above, the total flights going through Shanghai Pudong Airport has exceeded 2019 figures in 2024, and international flights specifically has exceeded 2019 figures in 2025. Further of note is that in 2024, total passengers passing through had hit a record high of 76.8 million (2019: 76.2 million), and current information available up to Sep 2025 indicates that total passenger count for 2025 is on track to reach 84 million. Why is this important? We will come back to this in a bit.

Depending on individuals, some might find a valuation of 10x P/E rich (because its China!) and some might find it cheap (stable volume-based business!). I would leave that for you to decide. Personally, I find such a valuation undemanding due to the nature of the business. An exercise for the reader here. Come up with a figure in mind for what a fair price to earnings ratio for SPIA should be and keep that figure there.

A missing piece of the puzzle

Now let’s discuss something that I couldn’t find any mention in the analysts' reports from DBS, OCBC, Phillip Securities and CGS International. The phase 4 expansion of Shanghai Pudong International Airport.

As per the news article

“The airport has a design throughput of 80 million passengers per year, and the new terminal will increase that by 50 million, operator Shanghai Airport Group announced today, adding that this marks a new stage of the fourth phase of the airport’s expansion.”

This is where the passenger throughput mentioned earlier in the article comes in. Shanghai Pudong International Airport has hit its maximum capacity and is currently in the midst of an expansion that would aim to deliver the following by 2030.

“With passenger traffic approaching the limit, Pudong Airport began planning the expansion in January 2022. According to the plan, the airport will serve 130 million passengers a year by 2030, operating 805,000 flights and delivering 5.9 million tons of cargo.”

For comparison, in 2024, the airport served 76.8 million passengers, operated 528,074 flights and delivered 3.77 million tons of cargo.

Coming up with your own TP

Now, with this new piece of information, what kind of P/E ratio would you deem fair for SPIA? That should allow you to come to your own view of what the floor price of this company’s shares should be. I am not sure why the analysts might have left out this piece of information from their analysis. Perhaps it is because completion is slated for 2028 and too far in the horizon? Perhaps this would only be a catalyst for rerating when flights going through the airport start increasing. That’s probably prudent since an increase in capacity does not mean that capacity will be filled.

Conclusion

Someone once said, “Being too early is indistinguishable from being wrong.”. Only time will tell whether the current valuation is cheap or rich. I believe though that many potential catalysts lie on the horizon and I am willing to wait while getting paid in dividends. On a personal note, I would find any take private proposals that happens as a knock-on effect from the restructuring of its parent company to be unwelcome news, cutting short any potential growth that shareholders can enjoy.

Disclaimer: All posts on The Squirrel's Drey are for informational and discussion purposes only. This is not a recommendation to buy or sell securities discussed. Please do your own due diligence before investing.

Comments